The Punjab Government Agricultural Loans 2025, offered under the Asaan Karobar Finance Scheme, are designed to help farmers and small business owners grow their livelihoods. This initiative makes it easier to get affordable financing for farming, livestock, and agri-based businesses.

In 2025, the government has upgraded the system to make the loan application faster, more transparent, and digitally trackable, helping deserving farmers access funds without hassle.

This article explains the full process, eligibility, documents, loan categories, and how to apply online.

What Is the Asaan Karobar Finance Scheme?

The Asaan Karobar Finance Scheme is a Punjab Government program that provides low-interest agricultural loans to farmers and rural entrepreneurs. Its main goal is to promote modern farming techniques, support financial inclusion, empower women and youth entrepreneurs, and encourage small and medium-scale agriculture.

Targeted Sectors

This scheme supports several areas of Punjab’s agricultural economy:

- Crop farming (wheat, rice, sugarcane)

- Livestock and poultry farming

- Fruit orchards and horticulture

- Small-scale agri-machinery and rural businesses

By reducing collateral and simplifying the process, the program enables thousands of farmers to access affordable finance.

Eligibility Criteria for Punjab Agricultural Loans

To qualify for the 2025 Asaan Karobar Finance Scheme, applicants must meet the following requirements:

| Eligibility Condition | Details |

|---|---|

| Residency | Must be a resident of Punjab |

| Business Type | Must be engaged in agriculture, livestock, or a related field |

| CNIC | Valid CNIC required |

| Business Proof | Evidence of ongoing farming or business activity |

| Credit Record | No default history in previous government loan programs |

Priority Beneficiaries

The Punjab Government gives preference to:

- Women farmers and entrepreneurs

- Young farmers and graduates in agriculture

- Small and medium landowners

- Projects adopting digital or modern farming tools

Loan Categories, Limits & Repayment Terms

The program offers flexible loan packages based on the type of agricultural activity:

| Type of Loan | Maximum Amount (PKR) | Repayment Period |

|---|---|---|

| Crop Production | 500,000 | 12 months |

| Livestock & Poultry | 800,000 | 24 months |

| Fruit Orchards & Horticulture | 1,000,000 | 36 months |

| Agri-Equipment & Small Business | 1,500,000 | 36 months |

Key Features

- Low interest rates subsidized by the Punjab Government

- Installments designed around crop cycles

- Minimal collateral for small farmers

- Transparent approval system with digital tracking

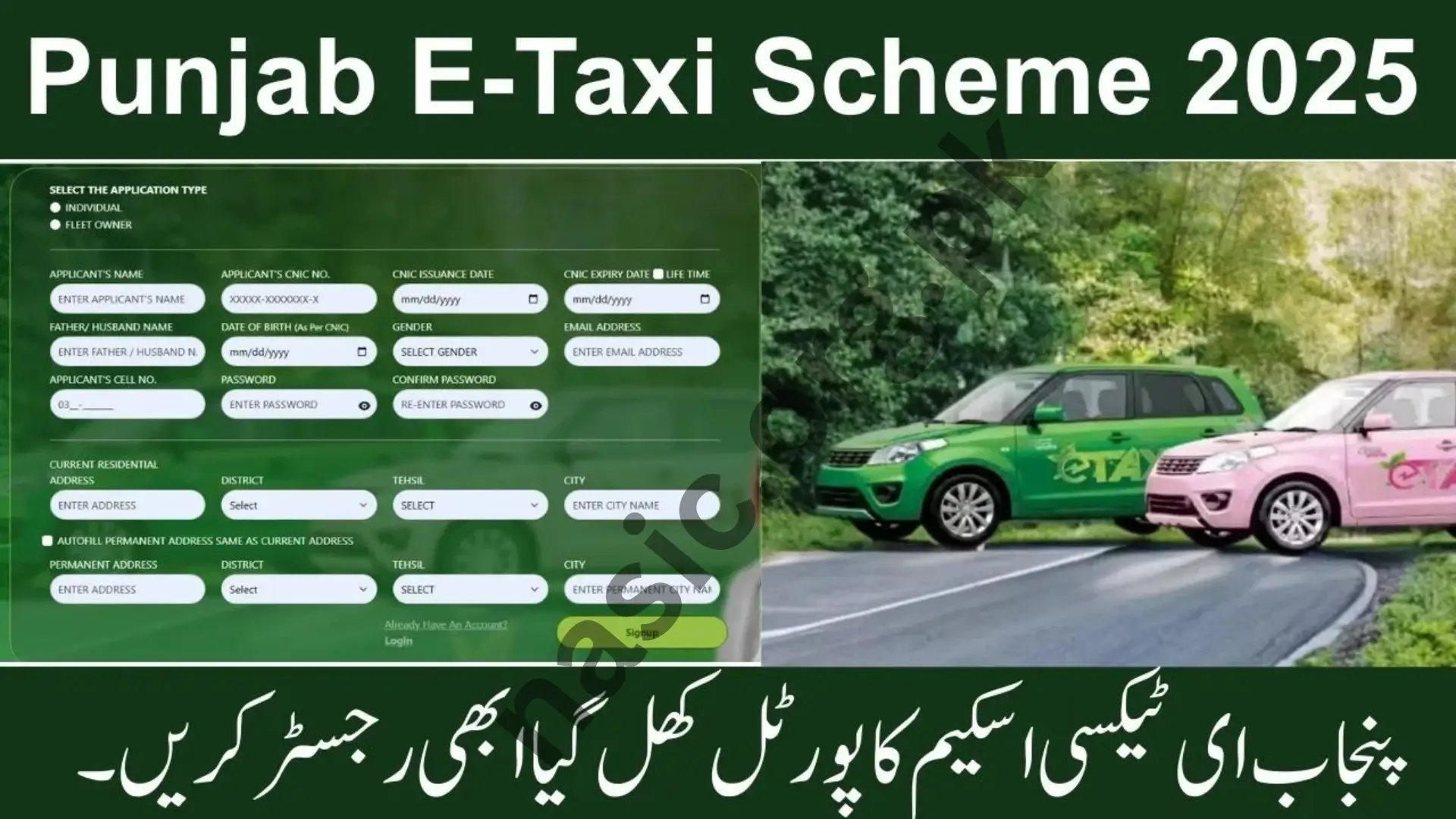

How to Apply for the Asaan Karobar Finance Scheme 2025

The 2025 process is easier and more digital than ever. Follow these steps:

- Visit the official Punjab government portal or your nearest agricultural office.

- Fill out the online form using your CNIC, business/farm details, and loan purpose.

- Upload documents such as farm proof or business income records.

- Submit the application and note the tracking reference number.

- Wait for verification and approval, usually within 15–30 days.

Tip: Keep copies of all submitted documents and your tracking number for future reference.

Required Documents for Application

| Document | Required | Notes |

|---|---|---|

| CNIC | Yes | Must be valid and original |

| Land or Farm Ownership Proof | Yes | Lease agreement accepted |

| Business/Farming Records | Yes | Income or harvest proof |

| Bank Account Details | Yes | Required for loan transfer |

Latest Government Updates for 2025

The Punjab Government has improved the Asaan Karobar Finance Scheme to make it more farmer-friendly.

- Higher loan limits for high-value crops and agri-businesses

- Digital tracking system for loan transparency

- Special quotas for women and youth

- Reduced interest rates and simplified documentation

These steps aim to increase productivity and ensure fair distribution of funds across Punjab.

Common Application Mistakes to Avoid

Avoid these errors to ensure smooth approval:

- Incomplete forms: Double-check before submitting.

- Invalid documents: Upload clear, correct files.

- Inactive bank account: Keep an updated account for fund disbursement.

- Previous loan defaults: Settle pending government loans first.

Digital Tracking and Transparency in 2025

For the first time, applicants can now apply online without visiting offices, track their application status via SMS or portal, and receive loan updates directly on their registered mobile number. This initiative promotes accountability, efficiency, and transparency, eliminating middlemen and delays.

Empowering Women and Youth Entrepreneurs

The Punjab Government is encouraging financial independence for women and youth through easier eligibility rules and flexible repayment terms. Women can start small-scale farms, poultry units, or horticultural projects, while young entrepreneurs can invest in modern equipment or agritech ventures.

Benefits of Punjab Agricultural Loans 2025

These loans bring multiple benefits for Punjab’s rural communities:

- Access to affordable credit for farming needs

- Ability to purchase modern equipment and better seeds

- Financial stability during crop cycles

- Support for rural employment and entrepreneurship

- Stronger contribution to Punjab’s food security

Types of Agricultural Loans & Their Advantages

| Loan Type | Key Benefits |

|---|---|

| Crop Production | Improves yield, quality, and seed access |

| Livestock & Poultry | Expands herds and increases income |

| Fruit Orchards & Horticulture | Offers long-term profits and export potential |

| Agri-Equipment & Small Business | Enhances efficiency and reduces labor costs |

Tips to Maximize Your Loan Benefits

- Plan loan usage based on your crop or business cycle.

- Maintain clear financial records for future applications.

- Use modern technology for better productivity.

- Repay installments on time to stay eligible for future financing.

- Get advice from your local agriculture office when needed.

FAQs About Punjab Agricultural Loans 2025

Q1. Who can apply for Punjab Government Agricultural Loans 2025?

Any Punjab resident involved in farming, livestock, or agri-business with valid CNIC and activity proof.

Q2. What is the maximum loan amount under this scheme?

Farmers can get up to PKR 1.5 million for agri-equipment or small businesses.

Q3. How long does the approval process take?

Most applications are approved within 15–30 days after verification.

Q4. Are there special benefits for women and youth?

Yes, both groups are prioritized and offered reduced collateral and simplified procedures.

Q5. Can I apply online for the Asaan Karobar Finance Scheme?

Yes, applications can be submitted through the official Punjab Government portal or local agricultural offices.

Conclusion

The Asaan Karobar Finance Scheme 2025 is a breakthrough opportunity for Punjab’s farmers and entrepreneurs. By applying carefully and using funds wisely, you can expand your business, improve productivity, and secure your family’s future. With simplified applications and digital transparency, the Punjab Government is ensuring that every deserving farmer gets the support they need to grow.